Travelling Allowance Subject To Pcb

This refers to the claims made by employees who are using their personal vehicle for official duties.

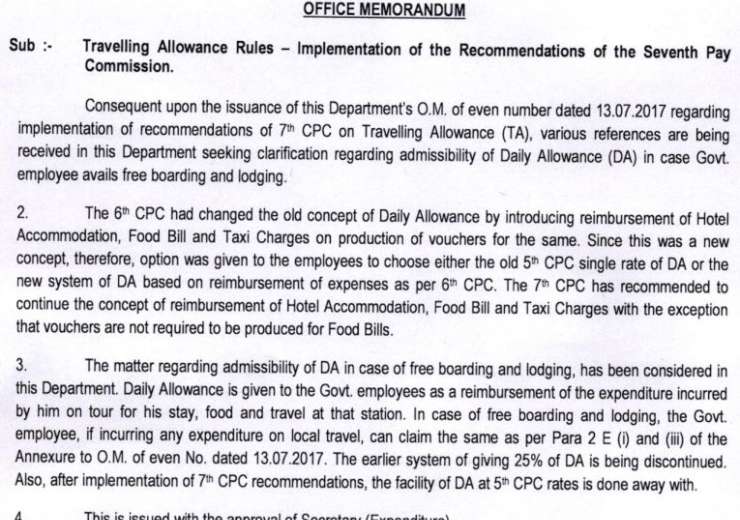

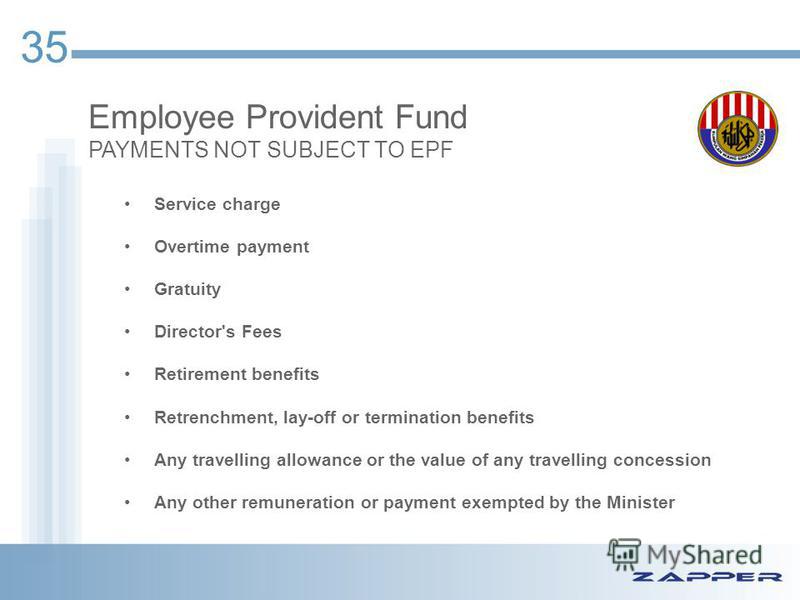

Travelling allowance subject to pcb. Employee must be a malaysian citizen employed under a service contract. While the act specifies that allowances are subject to epf it also specifies an overruling criteria whereby any travelling allowance or the value of any travelling concession are not subject to epf. Subject to levy a b e 1462 58 1784 00 1806 78 2283 42 4152 14 11768 92 levy psmb 14 63 17 84 18 07 22 83. As the scenario mentioned by the original author is mainly relating to transport these would not be taken into account for epf.

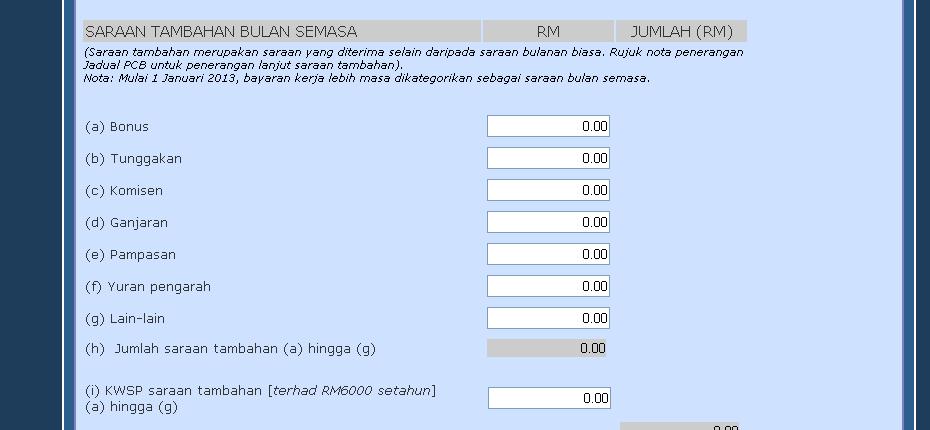

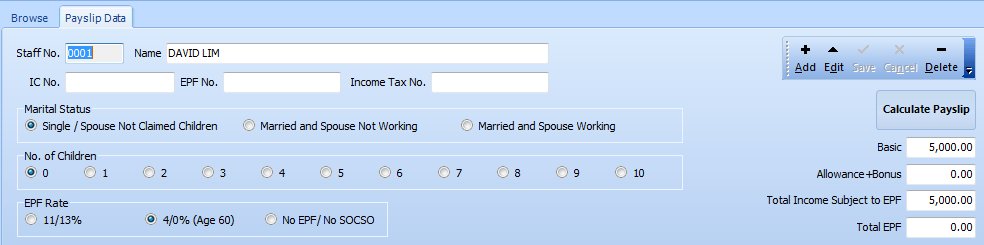

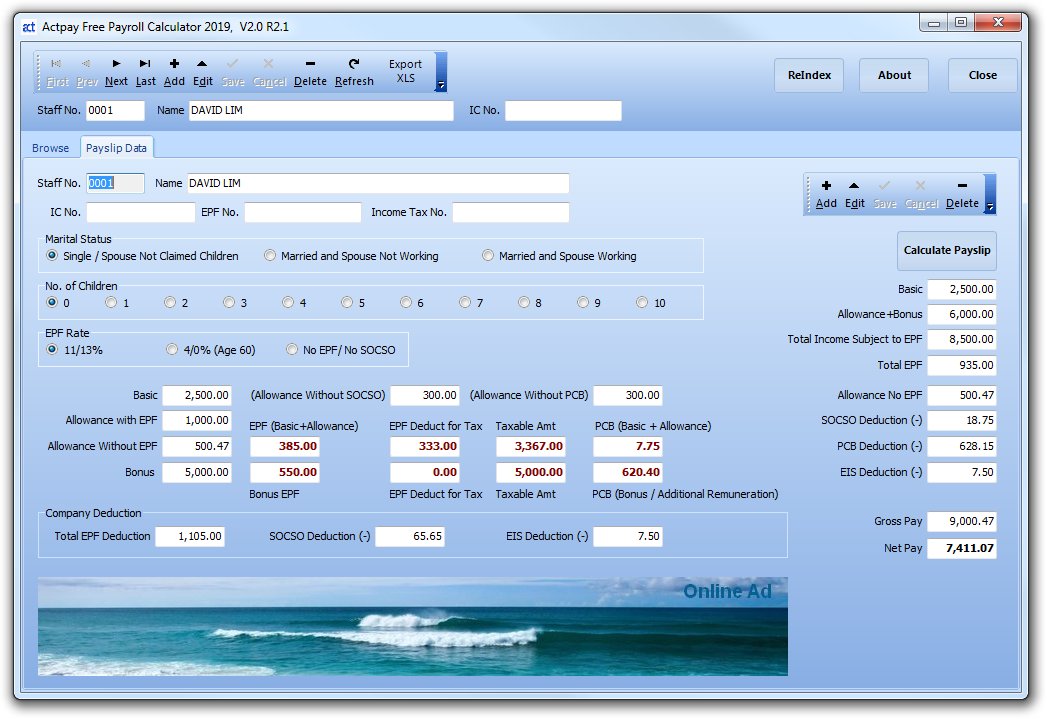

Subject exemption limit per year 1. Rate of contributions the current rates are 11 for the employee and 12 for the employer but employers are advised to keep abreast with changes which may take place from time to time. If these allowance is given through way of reimbursement then even at year end during submission of be form reimbursement allowances are not included in tax assessment. Payment in lieu of notice of termination of service.

And yes allowance is considered an income only if if it given fixed every month. Employers are legally required to contribute epf for all payments of wages paid to the employees. Only applicable for ya 2009 to 2010 travelling allowance petrol cards petrol allowance or toll. Allowance is subject to pcb deduction only if it is a benefit in kind.

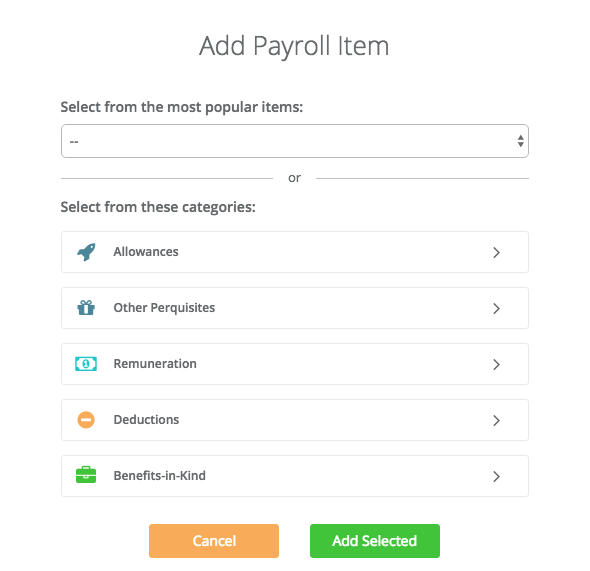

Petrol card petrol allowance travelling allowance or toll payment or any of its combination for official duties. Deductions such as epf socso zakat pcb and others. Rest days and public holidays reimbursement for travel from home office to the place of assignment not the normal place of work. However as the word is broad enough to include payments for food clothes accommodation phone calls etc reference can be had to case law to ascertain its scope.

Any traveling allowance or the value of any travel concession any payment paid by an employer to an employee for the purpose of travelling and transport expenses. Section 13 1 a allowances fixed allowance are taxable income except for the following exempted allowance from ya 2009 a travel allowance of rm2 400 per year would be exempted for travelling between home and work. Allowance except travelling allowance is included in the definition of wages under the epf act. Reimbursement for travel in the line of official duty reimbursement for travel between home and workplace beyond normal working hours e g.