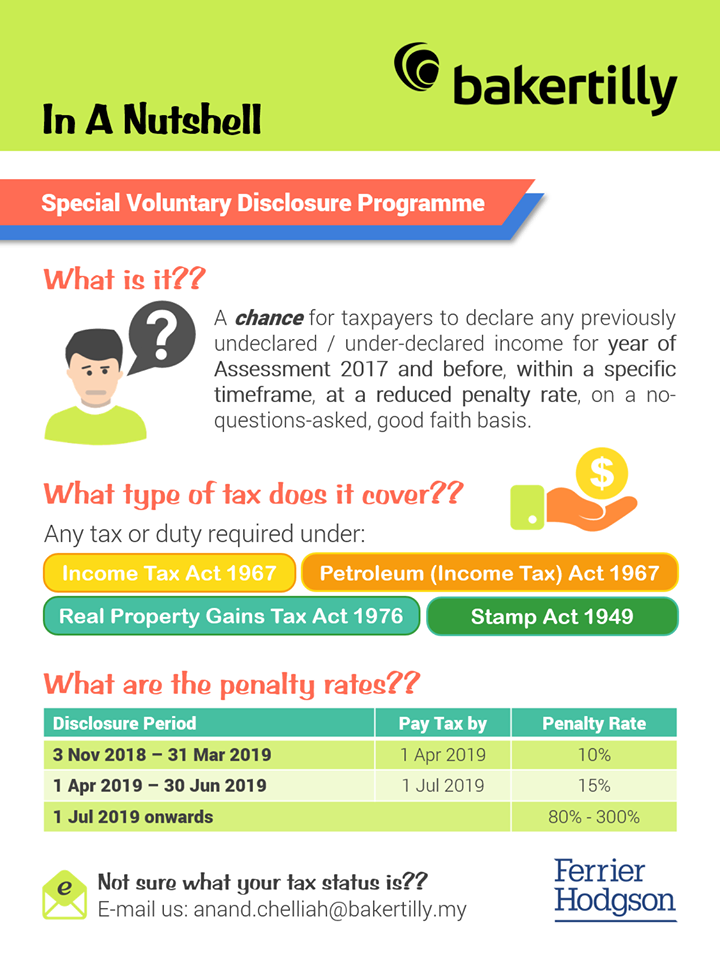

Special Voluntary Disclosure Programme

Iras voluntary disclosure programme iras understands that some taxpayers may occasionally make errors in their tax returns due to lack of care or awareness of their tax obligations.

Special voluntary disclosure programme. Special voluntary disclosure programme in a move to ease the burden of the people the government has announced a special voluntary disclosure programme voluntary disclosure in the 2019 budget speech. It is to encourage taxpayers to make voluntary disclosure in reporting their income to increase tax collection for the country s development. Besides malaysia countries offering voluntary disclosure programs include the united states of america united kingdom australia japan singapore and indonesia to name a few. In line with the new automatic exchange of information between tax authorities sars started receiving offshore third party financial data from other tax authorities in 2017.

The iras voluntary disclosure programme vdp encourages taxpayers who have made errors in their tax returns to come forward voluntarily in a timely manner to correct their errors. Besides malaysia countries offering voluntary disclosure programs include the united states of america united kingdom australia japan singapore and indonesia to name a few. Special voluntary disclosure program svdp to provide an opportunity for taxpayers to voluntarily come forward in declaring any unreported income for tax purposes including offshore accounts. Inland revenue board malaysia irbm jan feb 2019 nithea nadarajah special voluntary disclosure programme svdp.

This voluntary disclosure can be made at the nearest irbm office commencing from 3rd november 2018 until 30th september 2019. 1 4 hence this special program is offered to encourage taxpayers to make voluntary disclosure in reporting their full income and paying tax within the stipulated period. By participating in this svdp program the tax penalty. Individuals and companies could apply during the window period from 1 october 2016 until 31 august 2017.

Voluntary disclosure programme under the voluntary disclosure programme vdp individuals and companies are encouraged to voluntarily disclose their declaration errors and omissions. 1 4 the special program also gives an opportunity to taxpayers to report the. Voluntary disclosure in reporting their income and paying tax within the stipulated period. This special program is part of the government s efforts in tax reformation.

The programme is also part of the government s tax reform initiative in encouraging. Take advantage of the special voluntary disclosure programme. Disclosure applies to all types of offences under laws and regulations administered and enforced by singapore customs.