Withdraw Epf For House

You can make up to 3 withdrawals from these criteria.

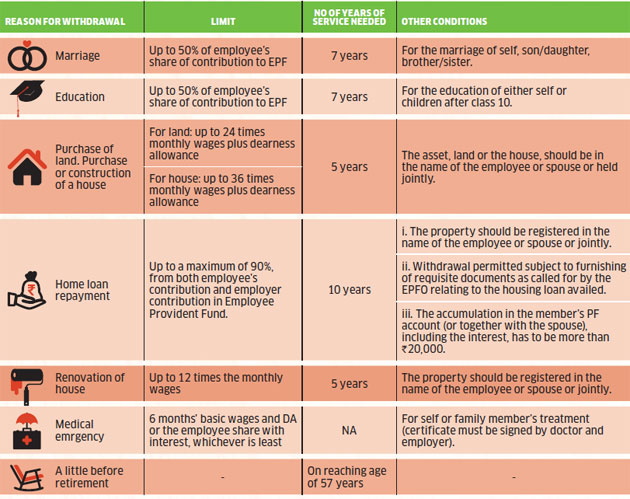

Withdraw epf for house. Epf allows members to make a partial or full withdrawal from their savings to pay for specific needs under medical housing loans and education. This new scheme is called as employee provident funds fourth amendment scheme 2017. I already wrote a detailed post on epf partial withdrawal rules. An employee can withdraw up to 90 of epf balance employee share and interest on that employer share and interest on that or the cost of the construction of property whichever is less.

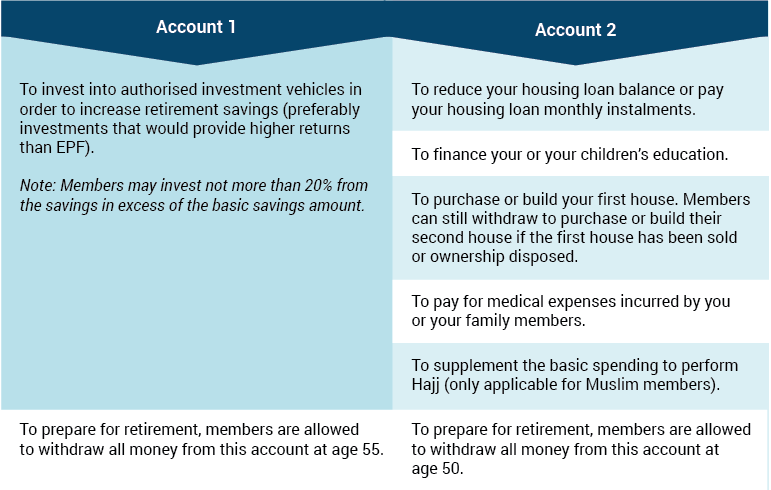

A person can apply for advance withdrawal if the individual has been a member of the epfo for a minimum of five years. You can withdraw up to 90 of the accumulated corpus for purchase of house or house site. 1 minimize monthly instalments you can withdraw to make your repayments more affordable and release some of your current financial burdens. An employee can withdraw up to 90 of the pf amount after attaining the age of 54 or one year before the age of superannuation whichever is later.

Epf changed certain rules in relation to epf withdrawal for house flat or construction of property. Epf withdrawal before 5 years of service. When you reach a certain age owning your own home will be high on your list of things to do. You can also withdraw epf for monthly home instalments.

The benefits of withdrawing from your epf account to purchase a house. These rules will come into effect from 12th april 2017. The plot where construction happens can be owned by the employee or employee spouse or jointly by both. It is applicable from 12th april 2017.

An individual who is a member of epfo is allowed to withdraw the amount for purpose of purchase or construction of house only once during the course of entire employment. A new epf withdrawal rule is out now you can withdraw 90 of epf balance for buying a house flat or under construction property. Here are the main amendments to epf withdrawal rules 90 of the epf balance can be withdrawn after the age of 54 years. In addition to withdrawal you can also use epf fund for repayment of home loan emi.

You can avail this partial withdrawal facility only once in your life for housing purposes. Epf withdrawals for housing. If you want to withdraw from epf for repayment of housing loan you must have completed 10 years of service. After leaving a job a person can withdraw 75 of the provident fund balance if he remains unemployed for 1 month and the remaining 25 after the second month of unemployment.

These changes are called as provident funds fourth amendment scheme 2017.