Tax Avoidance In Malaysia

Accordingly the scene for tax avoidance law in malaysia could be summed up as follows.

Tax avoidance in malaysia. In malaysia income tax act contains general and specific anti avoidance provision which empowers the director general to disregard schemes that are not commercially justified or are merely set up to avoid tax despite their legal form. Tax avoidance this alert talks about the delicate issue of tax avoidance under section 140 of the income tax act 1967. To apply for a certificate of residence one must contact tax authorities and present the passport and documentation of travel into and out of malaysia over the past one year. Tax resident status is just one element of the tax system of malaysia.

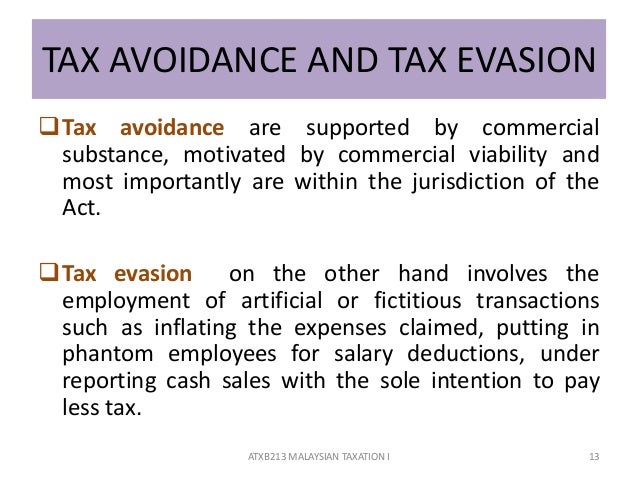

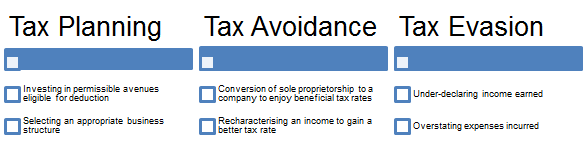

It discusses the decision of the court of appeal in a recent tax case and the questions on the parameter of legitimate tax planning. There is no cost of receiving a certificate of residence. We provide evidence from malaysia that corporate tax avoidance behaviour would actually reduce firm value and corporate governance has moderator effect on the relationship of tax avoidance and firm value. A tax avoidance involved sophisticate arrangements of rearranging or restructuring transactions in an attempt to minimise tax liabilities basing on the provisions set out in the income tax acts in a way that is not initially intended by the malaysian tax authority lhdn.

In malaysia there are general as well as specific anti avoidance provisions in place. It was conducted using cross sectional data by observing a final sample of 82 plcs at one point in time. Section 140 of malaysian income tax act 1967 the act provides that the director general of the inland revenue dgir has the power to disregard or vary any transaction to counteract its intended effect if the transaction is believed to produce the effect of altering the incidence of tax releiving from a tax liability evading or avoiding tax or hindering or preventing the operation of the act malaysian income tax act 1967. The text of this agreement signed on 26 december 1968 and is shown in annex a.

Unlike tax evasion it is a criminal activity that is strictly prohibited under the malaysia laws. Pwc alert issue 116. Income tax in malaysia is imposed on income accruing in or derived from malaysia resident and business. From the perspective of revenue authorities it is equally important to counter tax avoidance.

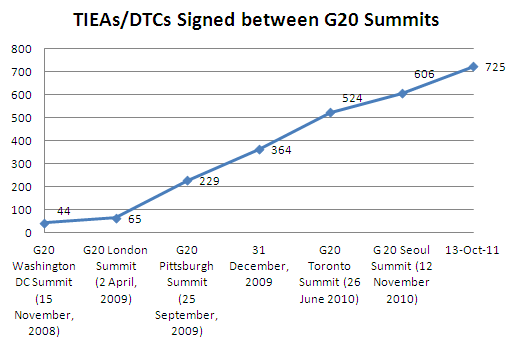

Where a taxpayer is accorded a tax benefit by virtue of the law and he arranges his affairs to enjoy that benefit which is permissible under the ita then such initiative does not amount to tax avoidance. Thus in most tax jurisdictions anti avoidance provisions are included in the tax laws to defeat or pre empt anticipated avoidance schemes mischief or to plug loopholes that have come to light. One thing worth mentioning is malaysia has an extensive number of double tax treaties available for the avoidance of double taxation.

/tax-avoidance-vs-evasion-397671-v3-5b71dfc846e0fb0025e54177.png)