Malaysia Employment Act Salary Calculation

The employment actsets out certain minimum benefits that are afforded to applicable employees.

Malaysia employment act salary calculation. Rm 3000 rm 2500 rm 5500 epf employer contribution. Employment law in malaysia is generally governed by the employment act 1955 employment act. Summary of employment laws in malaysia employment act 1955. For employees who receive wages salary of rm5 000 and below the portion of employee s contribution is 11 of their monthly salary while the employer contributes 13.

Weekly rate of pay. 2 this act shall apply to west malaysia only. 1d for the purposes of payment of sick leave under section 60f the calculation of the ordinary rate of pay of an employee employed on a daily or an hourly rate of pay or on piece rates under subsection 1c shall take account only of the basic pay the employee receives or the rate per piece he is paid for work done in a day under the contract of service. Rm 5500 x 11 refer third schedule.

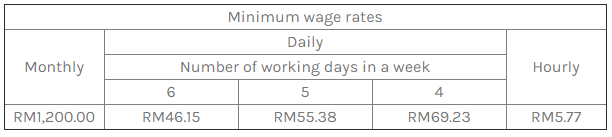

Short title and application 1 this act may be cited as the employment act 1955. The employment act provides minimum terms and conditions mostly of monetary value to certain category of workers any employee as long as his month wages is less than rm2000 00 and. Daily wages are calculated using either the gross rate for paid public holidays paid leave salary in lieu and salary deductions or the basic rate for work on rest days or public holidays. If the employee s salary does not exceed rm2 000 a month or falls within the first schedule of employment act.

1st june 1957 part i preliminary. Definitions and calculation you may receive a monthly or daily salary. In this article we will study the laws governing the hours of work and overtime work for employees under malaysia s labour laws. The employment act 1955 is the main legislation on labour matters in malaysia.

But overtime can be a very confusing matter. For employees who receive wages salary exceeding rm5 000 the employee s contribution of 11 remains while the employer s contribution is 12. Payroll cycle if you are covered under the employment act 1955 your employer must pay your salary at least once a month. Monthly and daily salary.

Rm 5500x 12 calculation by percentage epf employee contribution. In malaysia overtime is still popular among companies especially in the f b sector. An act relating to employment. Interpretation 1 in this act unless the context otherwise requires.