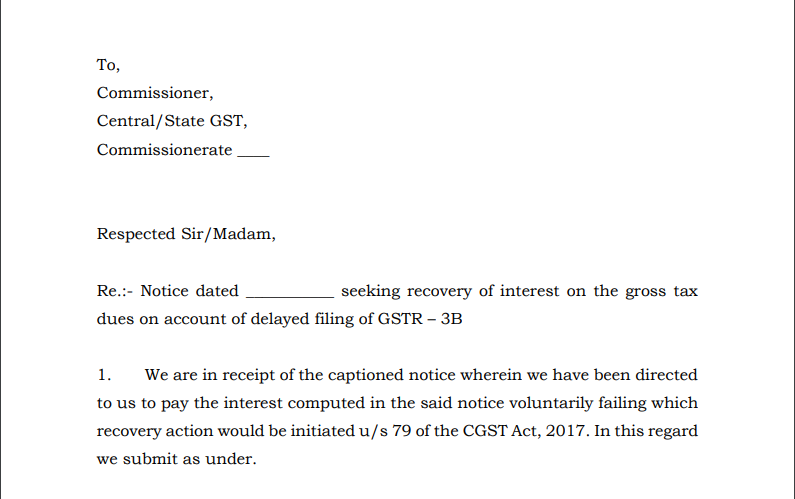

Gst Show Cause Notice Reply Letter Format

Date rpad speed post.

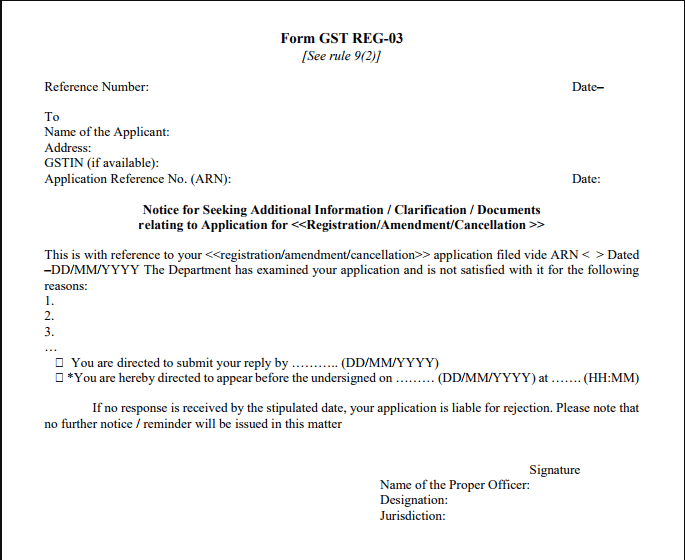

Gst show cause notice reply letter format. Draft reply after confirmation of applicability could include the following points provided. Address of the principal place of business 6. Gst officer issuing notice cc to commissioner sgst. Reply to the notice to show cause.

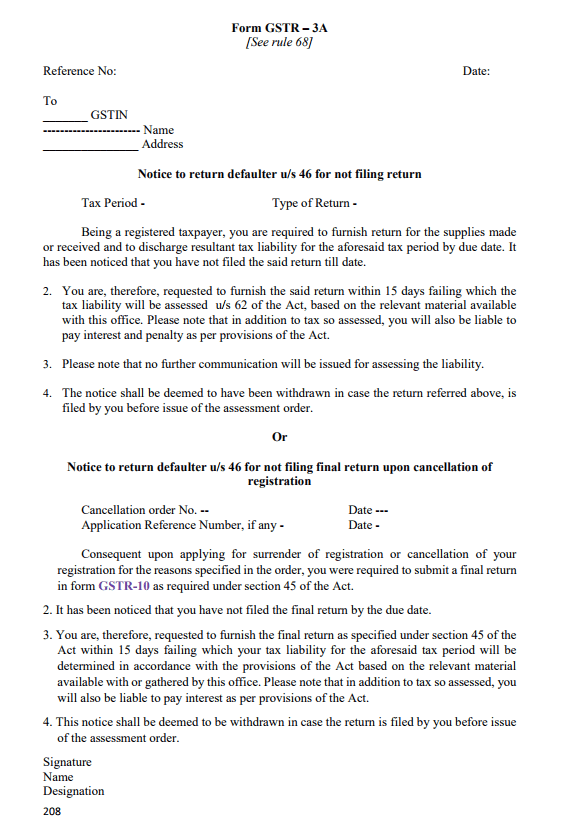

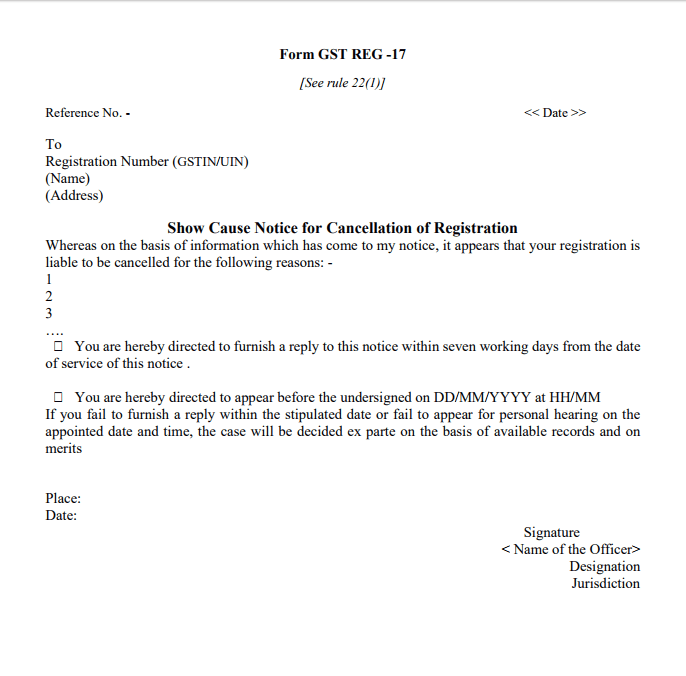

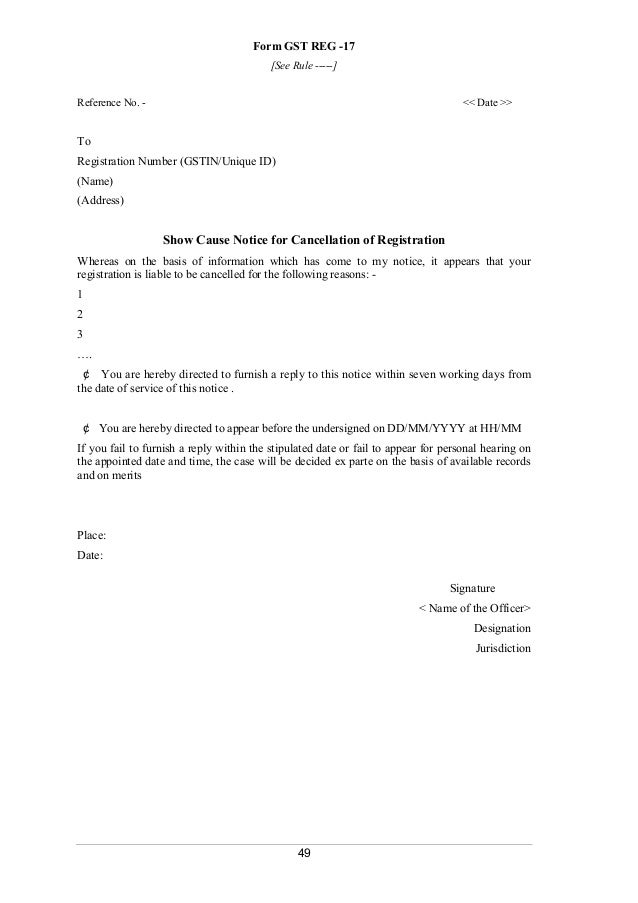

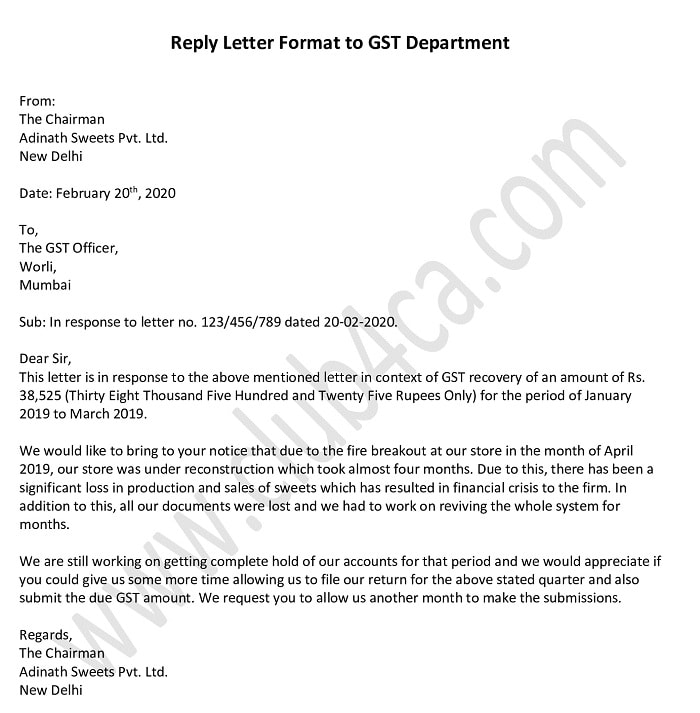

Handling a show cause gst notice and gst notice reply letter format. Sample letter reply show cause notice form forms forms income tax goods and services tax gst service tax central excise custom wealth tax foreign exchange management fema delhi value added tax dvat sez special economic zone llp limited liability partnership firm. Within 7 working days from the date of receiving the notice. Show cause notice why should the gst registration not be cancelled for the reasons laid down in the notice.

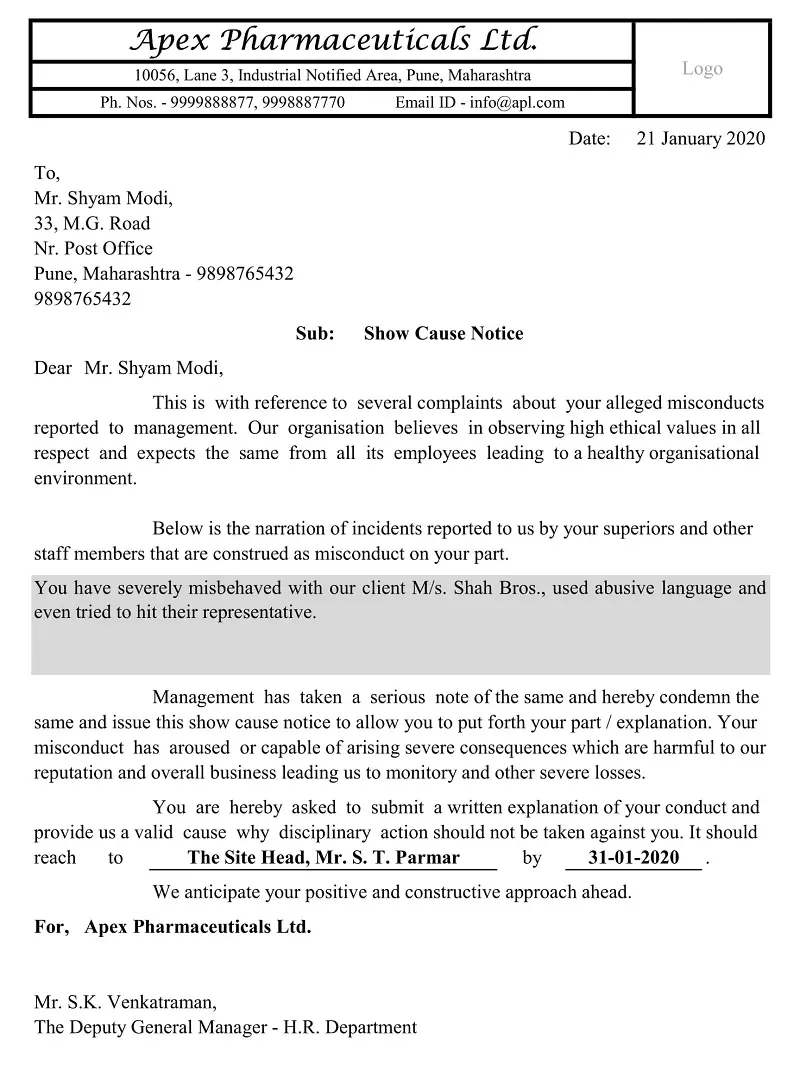

Show cause letter for late attendance. Reply to the notice 7. Draft reply for gst notices form 3b and 2a. This is in reply to the notice i received for late attendance during the past two weeks.

Details of the show cause notice reference no. To concerned hr personnel name subject. Date of notice and date of receipt of gst notice could be different. During the course of their compliance aspect in gst.

The gst authorities shall call for the objections if any and then the registered person in reply to the show cause notice has to file its objections in form gst cmp 06 accompanying. Unfortunately my mother who is above 65 years of age has a fractured ankle. This handbook on show cause notice approach and reply under gst is comprehensive containing analysis of the entire provisions under the law including notifications circulars or orders upto 31st july 2020 issued by the government from time to time along with few faq s mcq s flowcharts. While acknowledging the show cause gst notice always remember to put date and time over the.

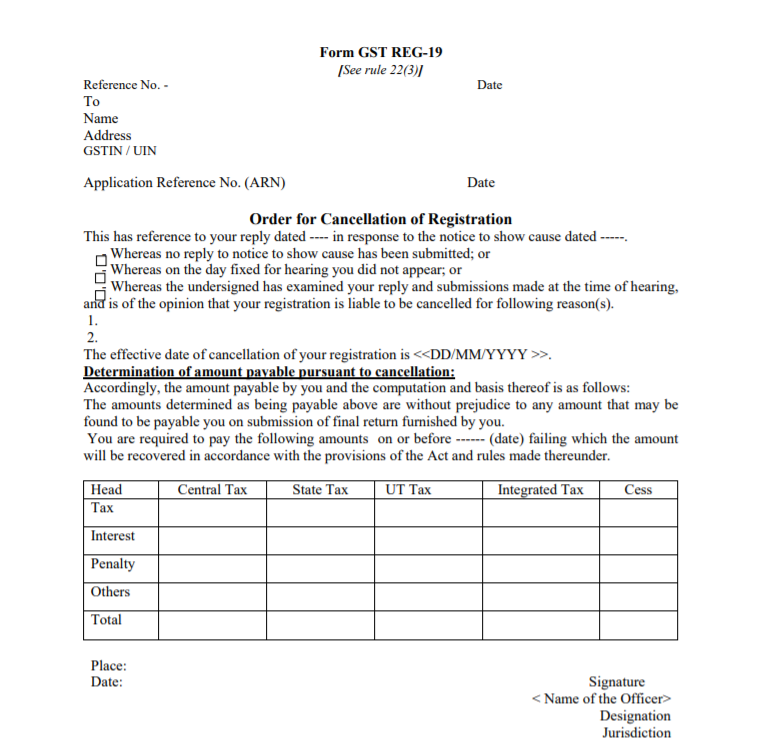

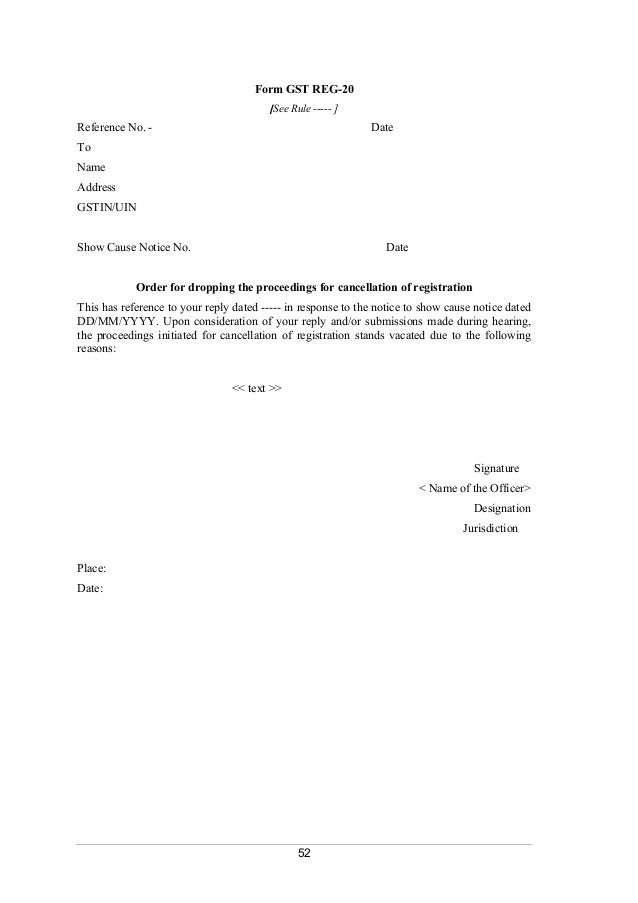

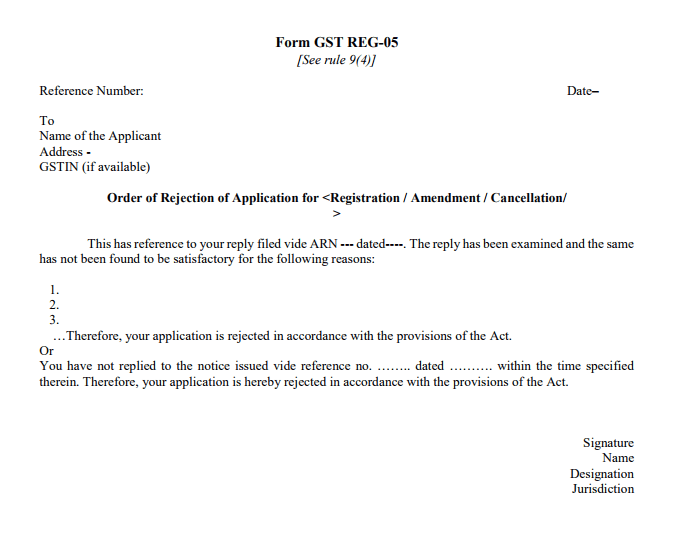

Gst notice reply letter format in word in. Show cause notice why the cancellation. Before resorting to the assessment the gst authorities shall issue a show cause notice proposing the tax due to the department basing on the information submitted in compliance to the assessment notification. Reply letter in reg 18 with the reasons for non cancellation of gst registration.

Reply to show cause letter for misconduct reply to show cause letter for late attendance. The points stated below are important to note while handling show cause gst notices. Account documents examples company secretary documents corporate requirements legal documents requirements if you are looking for how to respond to sales tax gst recovery notice show cause notice for non filing of gst return cancellation of registration mismatch in input credit etc you are at right place. Trade name if any 5.

Cancellation of gst registration in reg 19.