Exempt Private Company Malaysia

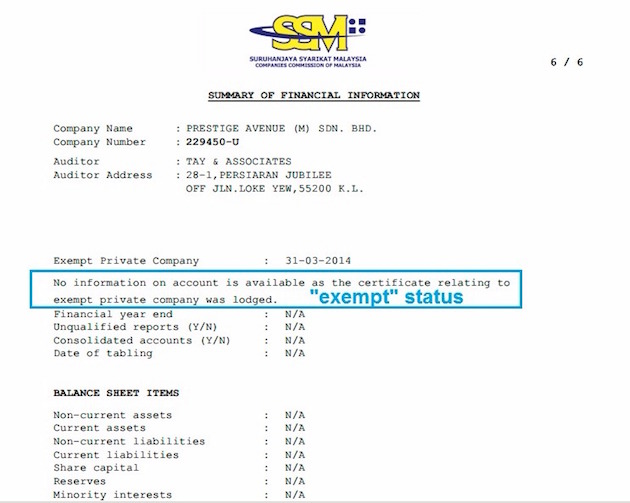

However an exempt private company needs to file with ccm a certificate that is signed by the director of the company the secretary and the auditor of the company stating that.

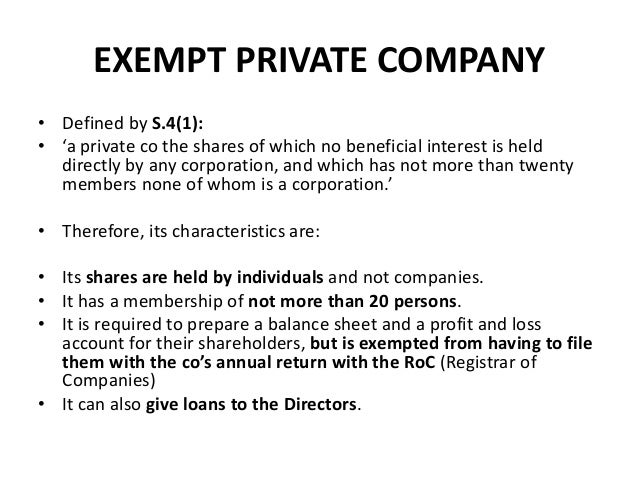

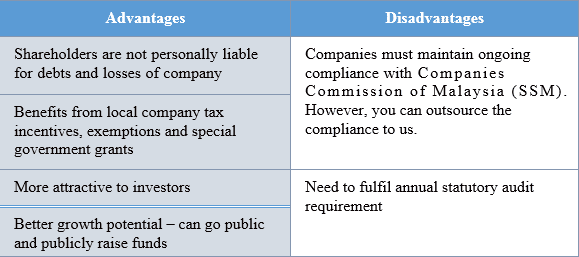

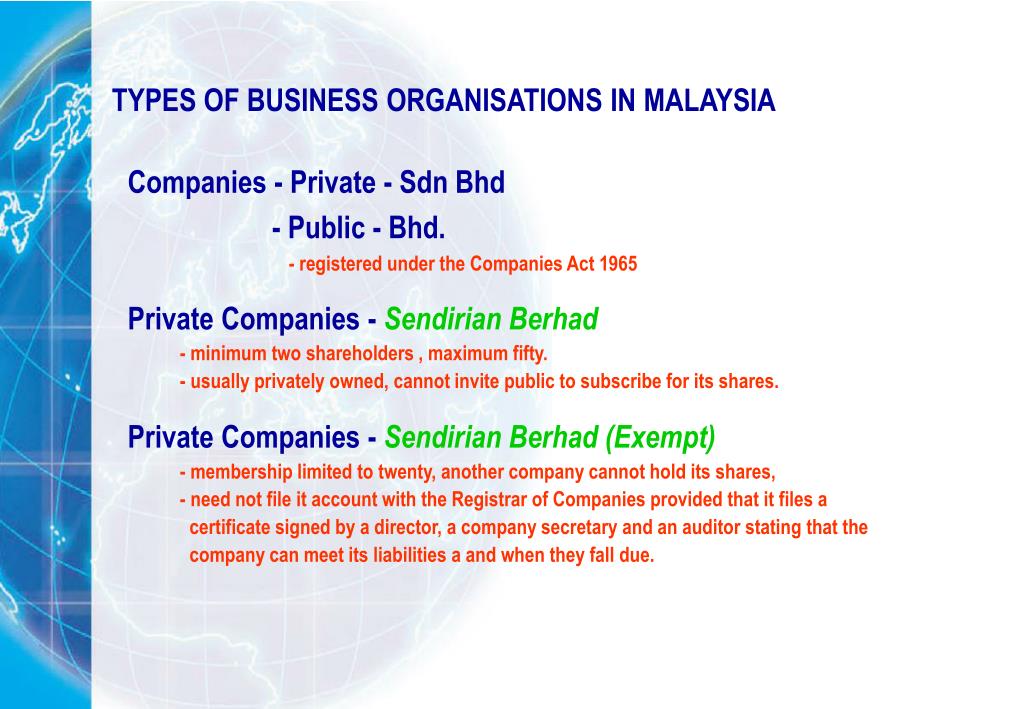

Exempt private company malaysia. Also none of the shareholders is a corporation. Subsection 267 1 of the companies act 2016 requires every private company to appoint an auditor for each financial year of the company for purposes of auditing its financial statements. If the number of shareholders exceeds 50 it becomes a public company. Exempt private company in malaysia.

Profit and loss account includes income and expenditure account revenue account or any other account showing the results of the business of a corporation for a period. Exempt private company limited by shares an exempt private company limited by shares is a private company which has at most 20 shareholders. However pursuant to subsection 267 2 of the ca 2016 the registrar may exempt any private company from having to appoint. Finally if the number of shareholders is 20 or less with no corporation holding any beneficial interest in the company s shares it is known as an exempt private company epc.

Which has not more than 20 members none of whom is a corporation. C any company converted into a private company pursuant to section 26 1 being a company which has not ceased to be a private company under section 26 or 27. Taxation for exempt private limited companies these companies enjoy the tax exemptions and incentives offered by singapore tax authorities to other companies. Private company limited by shares a private company is a company with.

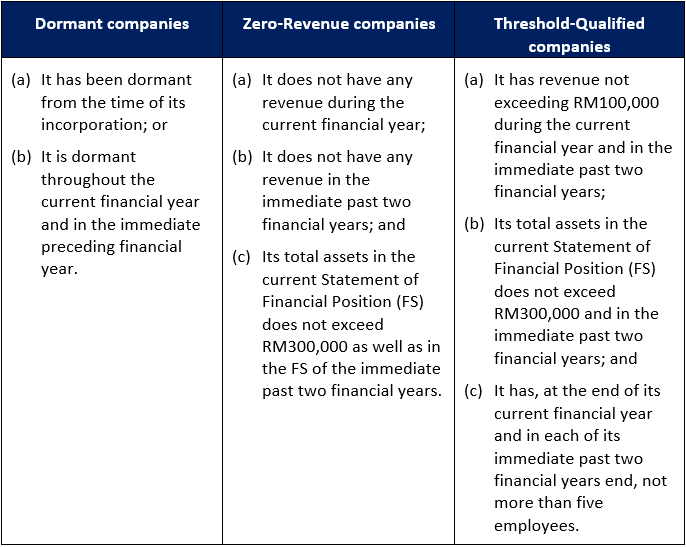

It can also be a company which the minister has gazetted as an exempt private company. Based on the ca 2016 exempt private company means a private company. 3 2017 pd 3 2017 setting out the qualifying criteria for audit exemption for certain categories of private companies. If the company has more than 20 but less than 50 shareholders it s called a private company.

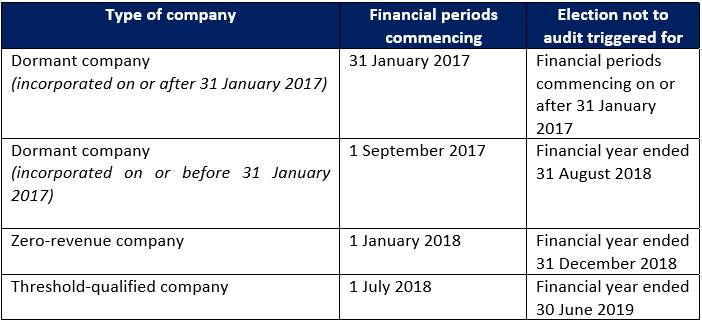

Exempt private companies are independent in regard to the guarantee for the internal company loans to its directors. The government agencies tries to support newly formed companies by allowing them to have financial benefits in order to help them survive the difficulties of these years. Introduction of audit exemption for private companies by the companies commission of malaysia introduction ccm had on 4 august 2017 issued a practice directive no. Issued pursuant to section 20c of the companies commission of malaysia act 2001 and subsection 267 2 of the companies act 2016 ca 2016 this practice directive rolls out the qualifying criteria for private companies from having to appoint an auditor in a financial year i e.