E Filing Income Tax Malaysia

Please take note.

E filing income tax malaysia. You must pay income tax on all types of income including income from your business or profession employment. Telefon bimbit yang berdaftar dengan lhdnm. 2 only gif file format is allowed and the file size must be from 40k and not more than 300k. 2017 12 05 14 47 25 ibu pejabat lembaga hasil dalam negeri malaysia menara hasil persiaran rimba permai cyber 8 63000 cyberjaya selangor.

Number is required. Hasil care line 03 8911 1000 603 8911 1100 luar negara waktu operasi. You can file your taxes on ezhasil on the lhdn website. How to file your personal income tax online in malaysia.

3 file name must only contain alphanumeric characters a z a z and 0 9. Tax administration diagnostic assessment tool tadat association of tax authorities. How to file your taxes manually in malaysia. The deadline for filing your income tax returns form in malaysia varies according to what type of form you are filing.

Isnin hingga jumaat 9 00 am hingga 5 00 pm. Sila login ke laman e filing dan pilih menu terlupa kata laluan untuk mendaftar. For the be form resident individuals who do not carry on business the deadline for filing income tax in malaysia is 30 april 2020 for manual filing and 15 may 2020 via e filing. Tax offences and penalties in malaysia.

What is defined as income. Dimaklumkan bahawa pembayar cukai yang pertama kali melaporkan pendapatan menyamai atau melebihi rm 450 000 melalui hantaran borang secara e filing perlu memohon tac. Gone are the days of queuing up in the wee hours of the. Subscribe to mypf youtube q1.

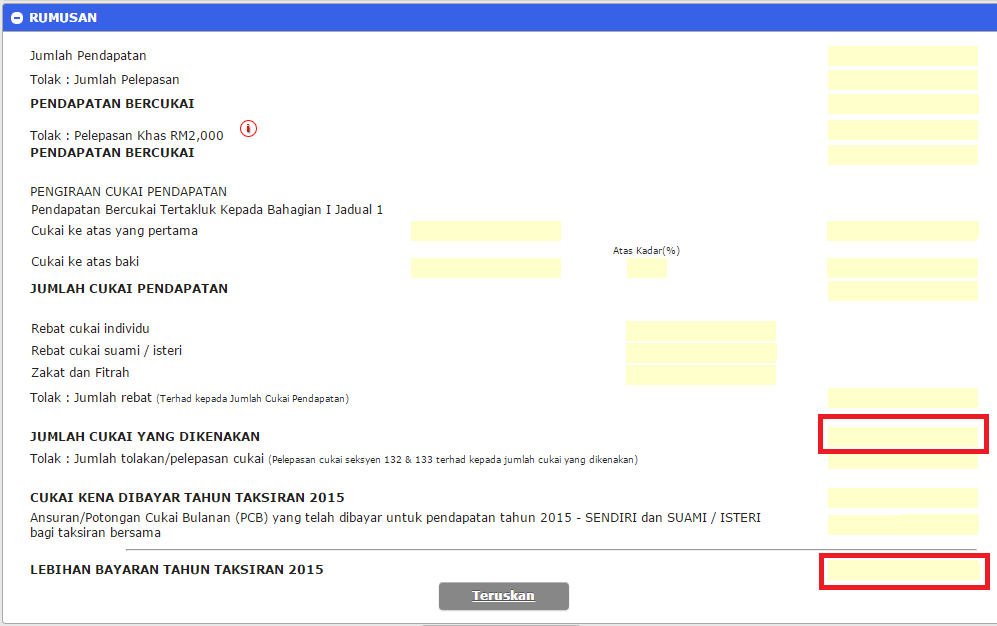

Malaysia income tax e filing guide. 1 only the front of your identity card showing your name and identification card. The next thing you should do is to file your income tax do it online. How to file income tax as a foreigner in malaysia.

How to pay income tax in malaysia. E permohonan pindaan be adalah permohonan pindaan atas kesilapan atau khilaf bagi borang nyata cukai pendapatan yang telah dikemukakan secara e filing atau m filing dalam tempoh semakan pengesahan semakan semula pengesahan penerimaan borang yang telah dihantar secara e filing. Before you can complete your income tax returm form itrf via ezhasil e filing the first step you have to take is to register at ezhasil e filing website. Please bear in mind that you must be registered as taxpayer prior to registering for ezhasil e filing.