Director Fee Subject To Epf

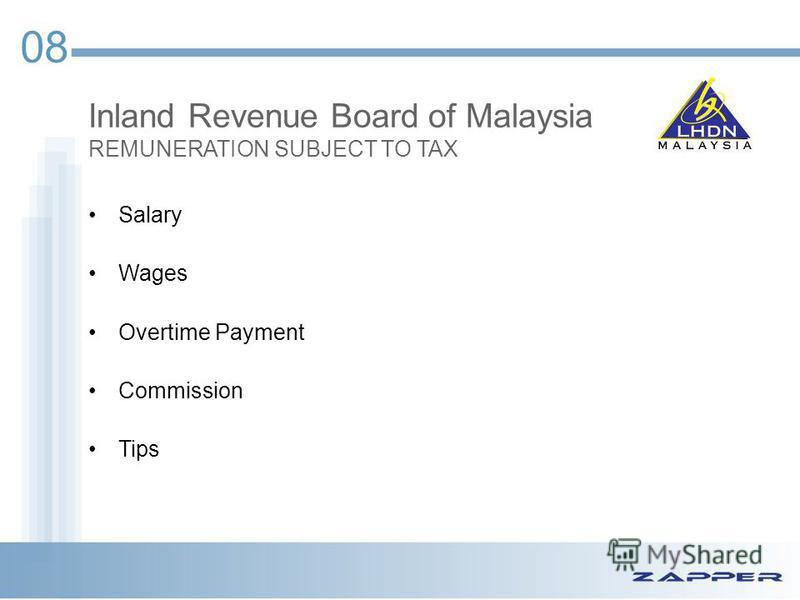

Epf socso payout on director is tax deductible as company expense.

Director fee subject to epf. No non malaysian employees are not required to contribute but they are given the option to contribute. He can also be an employee on a contract of employment if you are still on a contract of employment for which you are paid salary separately then you need to contribute to the epf based on yr earnings as an employee. Please refer to the ministry of manpower website for more information on a contract of service. Do foreigner expatriate employees have to contribute epf.

Director salary fixed drawing every month. Directors of a company are considered employees if they are engaged under a contract of service and paid a salary on top of any directors fees received. A director can be employed in a dual capacity i e as a director who is the directing mind and will of the company and who can formulate and determine policies. Difference between director drawing salary vs director fee director fee once in a year so you only declare when there is profit.

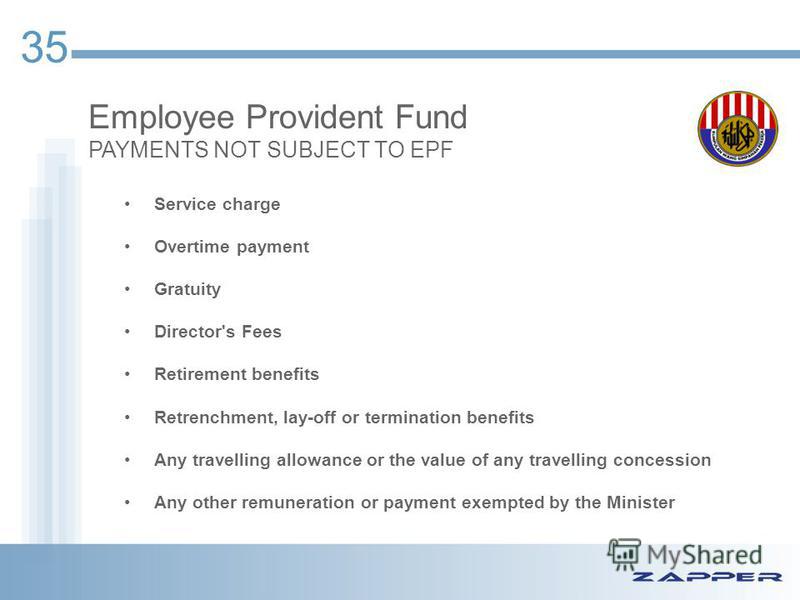

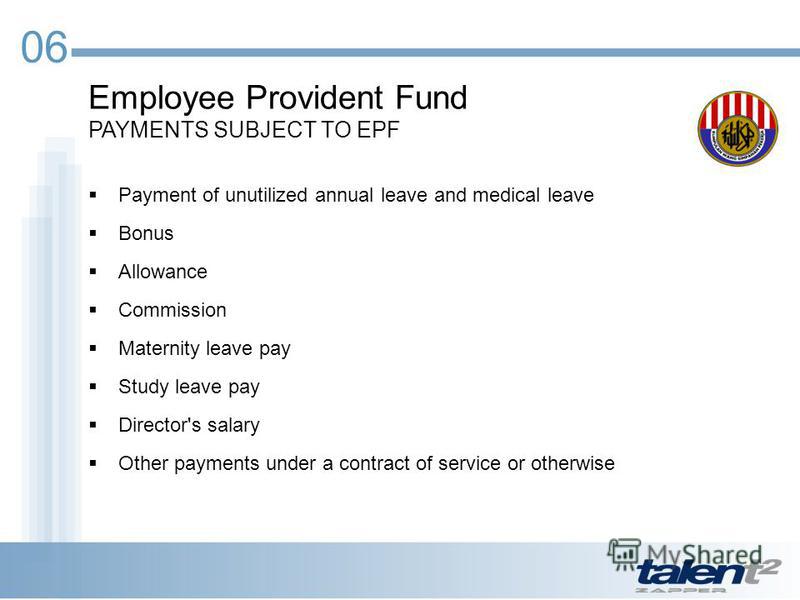

Director s fees are fees to be paid to a director in their capacity as company director for the directorial services they perform for the company. Employers are legally required to contribute epf for all payments of wages paid to the employees. Hence the earliest date on which the director is entitled to the director s fees is the date the fees are voted and approved at the company s agm. In general all monetary payments that are meant to be wages are subject to epf contribution.

Cpf contributions are not payable on directors fees voted to them at general meetings. The type of remuneration received will affect the need for disclosure of the remuneration the making of cpf contributions and also whether such payment will be subject to tax. Rate of contributions the current rates are 11 for the employee and 12 for the employer but employers are advised to keep abreast with changes which may take place from time to time. Yes pf contributions are not payable on directors fees voted to company directors at general meetings.

Director s fee fee paid to the director. If you are wonder can a owner to contribute epf and his spouse then look no further on the contribution list. Statutory contribution for owner spouse an act to provide for the law relating to a scheme of savings for employees retirement and the management of the savings for the retirement purposes and for matters incidental thereto. Company directors are considered employees if they are engaged under a contract of service and paid a salary on top of any fee received.

No concurrent employment is cpf payable. Director s fees approved in arrears the company voted and approved director s fee of 20 000 on 30 jun 2019 to be paid to you for your service rendered for the accounting year ended 31 dec 2018. Gifts includes cash payments for holidays like hari raya christmas etc read more about. Company directors is cpf payable.

Epf contribution rates.